Widening OI bases point to bullish bias

Put writers displayed activity particularly at the 22,200 and 22,000 strikes

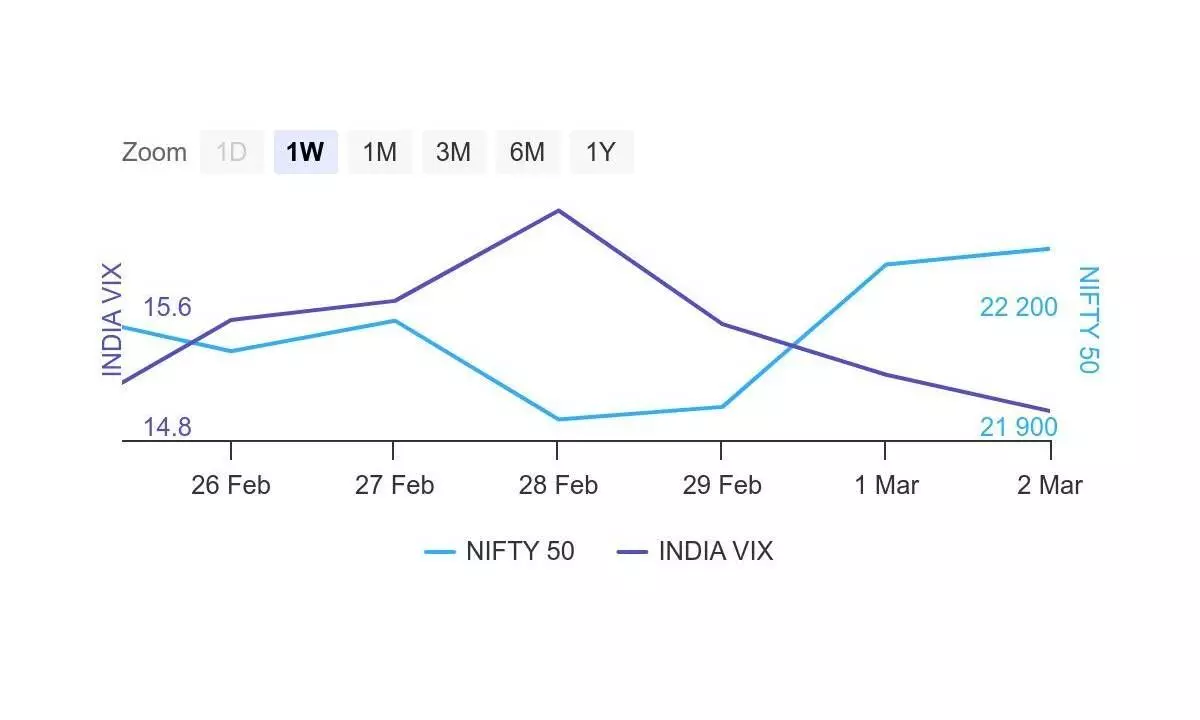

image for illustrative purpose

The support and resistance levels remained at 22,000PE and 23,000CE strikes respectively for the second consecutive week. However, Open Interest (OI) bases widened at Out of Money (OTM) strikes on both sides of the options chain. It’s indicating consolidation at higher levels, observe derivatives analysts.

The 23,000CE has the highest Call OI followed by 22,800/ 22,500/ 22,600 / 22,7000/ 22,900/ 23,100 strikes, while 22,800/ 22,500/ 23,100/ 22,600 strikes recorded reasonable addition of Call OI.

Coming to the Put side, the maximum Put OI is seen at 22,000/ 21,000/ 22,200/ 21,500/ 21,600/ 21,900/ 22,300 strikes. Further, 22,200/ 22,100/ 22,000/22,300 21,500/ 22,400 strikes witnessed a significant build-up of Put OI.

Dhirender Singh Bisht, associate vice-president (technical research) at SMC Global Securities Ltd, said: “Analyzing Nifty’s derivatives data, the highest Call writing seen at the 22,800 and 22,500 strikes. Conversely, Put writers displayed activity, particularly at the 22,200 and 22,000 strikes.”

“The preceding week saw a significant downturn in mid-cap and small-cap shares following Sebi’s directive to AMC managers, urging them to provide investors with more comprehensive information regarding the risks associated with their small- and mid-cap funds. Sectors that experienced declines in the last week include media and healthcare, whereas metal, consumer durables, and auto emerged as the major gainers,” added Bisht.

BSE Sensex closed the week ended March 2, 2024, at 73,806.15 points, a net gain of 663.35 points or 0.90 per cent, from the previous week’s (February 23) closing of 73,142.80 points. During the week, NSE Nifty was also up by 165.70 points or 0.74 per cent at 22,378.40 points from 22,212.70 points a week ago.

Bisht forecasts: “In the upcoming week, Nifty may test upside resistance at 22500 whereas on the downside support is placed at 22,000.”

“The March series kicked off on a robust note, witnessing a notable surge in Nifty by over 1.6 per cent during Friday’s session, while Bank Nifty recorded a gain exceeding 2.5 per cent,” remarked Bisht. India VIX fell 2.17 per cent to 15.24 level. “Implied Volatility for Nifty’s Call options settled at 14.25 per cent, while Put options concluded at 15.02 per cent. The India VIX, a key indicator of market volatility, concluded the week at 15.57 per cent. The Put-Call Ratio of Open Interest stood at 1.36 for the week,” said Bisht.

“Meanwhile, the Nifty’s rollover is slightly lower than the preceding month, standing at 79.31 per cent, but surpassing the three-month average for the current month. Analyzing the rollover data suggests sluggish movement in Bank Nifty, while Nifty is anticipated to exhibit a pattern similar to the last series,” added Bisht.

Bank Nifty

NSE’s banking index closed the week at 47,297.50 points, higher by 485.75 points or 1.03 per cent from the previous week’s closing of 46,811.75 points.

“In Bank Nifty, the highest Call Open Interest was observed at the 48,000 and 47,500 strikes, while on the Put side, it was concentrated at the 46,500 and 47,000 strikes. The Bank Nifty’s rollover rate for the March series has declined as compared to the previous one, registering at 74.24 per cent, down from 77.05 per cent in the prior month. The current month’s rollover for Bank Nifty is under the three-month average,” observed Bisht.